Introduction

Sending money abroad from Bolivia has become a real headache for individuals and businesses. In theory, banks should offer fast and secure solutions, but in practice, the experience is slow, expensive, and limited. Adding to this is the lack of foreign currency faced by the country's financial institutions, which in many cases makes it nearly impossible to complete an international transfer through the traditional banking system.

Faced with this situation, more efficient digital alternatives are emerging that eliminate many of the usual obstacles. In this article, we will analyze the difficulties of the current system, the hidden costs faced by users, and how modern platforms are changing the way money is sent abroad from Bolivia.

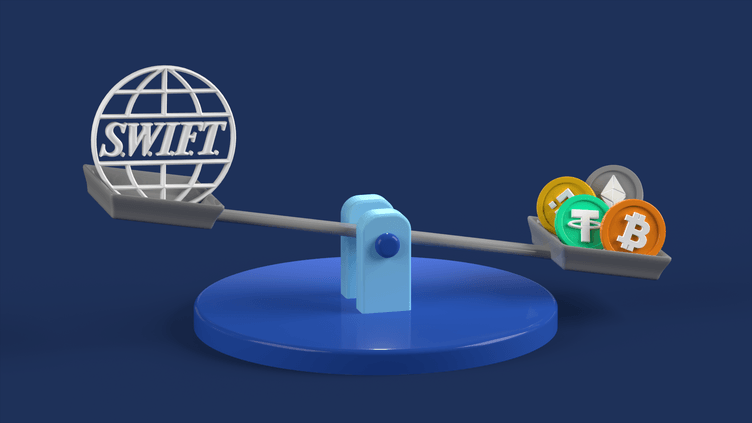

The SWIFT System: A Slow and Inefficient Network

The SWIFT system has been the global standard for decades for sending money from one country to another. However, it is far from efficient. Each transfer can pass through multiple intermediaries—from correspondent banks of both the sending and receiving banks to regulatory and verification entities—which slow down the process. This means that a transfer typically takes several business days to complete despite the simplicity of the service required, making this method feel outdated in the 21st century.

Furthermore, during the transaction process, obtaining information about the status of the sent funds is quite an ordeal: a form must be filled out for a bank to initiate a chain of interbank inquiries, and then a response must be waited for an indefinite amount of time. One can only imagine how complicated it is to resolve the transaction if something goes wrong…

Exorbitant Bank Fees

Beyond the slowness, one of the biggest problems is the high cost, comprised of the commission and the exchange rate imposed by the bank. Bolivian banks typically charge between 2% and 7% in commission, on top of their profit from the exchange rate—which is already higher than the parallel market rate. To this must be added the commission charged by each bank in the transfer chain, each taking its cut. And in the end, the recipient might receive less than expected, since the receiving bank may charge a receiving fee that is not included in the SWIFT system.

The Branch Ordeal: Queues and Waiting Lists

Added to this is the in-person experience. To make an international transfer at a Bolivian bank, you usually have to stand in long lines, wait your turn, fill out lengthy forms, and undergo multiple verifications.

Even worse: even after going through all that, it's not always possible to access the full amount you want to transfer. Banks impose strict volume limits, so sometimes the customer has to wait weeks or months to be able to send the money they need.

An Aggravating Circumstance: Lack of Funds in Banks

The current situation of the Bolivian banking sector further aggravates the outlook. Many banks simply do not have the necessary liquidity to execute transfers abroad. In other words: even if the customer has money in their account, the bank cannot always convert and transfer it in dollars or other currencies. This turns the process into a lottery: it's not enough to have funds, you also have to hope the bank has them available.

A Modern Alternative: Cryptocurrency Transfers

Faced with so many obstacles, platforms like PrismaPay.net offer a real and modern solution—cutting-edge innovation that surpasses the shortcomings of the past. Their approach focuses on lowering costs, increasing speed, and removing restrictions through the use of blockchain technology. In other words, instead of relying primarily on the banking system, they use a dynamic network of servers that operate 24/7 according to a strict digital security protocol. The benefits are remarkable:

Lower Fees: The fees are clear and competitive: 3% or less, depending on the volume. Unlike banks, there are no hidden charges disguised in the exchange rate.

Speed: While a bank can take between 3 and 7 business days to complete a transfer, with PrismaPay the money can arrive in as little as one hour.

No limits or waiting lists: No matter the amount: with PrismaPay there are no restrictions or monthly limits. There are also no waiting lists. The user can send the money they need, when they need it.

Simplicity: Opening an account is much easier than doing so at a traditional bank. The process is digital, without endless paperwork or lines at the teller window.

Transparency: Every transfer can be tracked in real time, providing peace of mind and security to the user.

Direct Comparison: Banks vs. PrismaPay

| Appearance | Traditional Banks | PrismaPay |

|---|

| Shipping Time | 3-7 business days | From 1 hour |

Fees | 2%-7% (parallel exchange rate) | ≤3% depending on volume |

| Fund Availability | Limited, with waiting list | Unlimited |

| Account Opening | Slow and bureaucratic | Simple and digital |

| Transfer Tracking | Partial or nonexistent | Real-time |

Conclusion

Sending money abroad from Bolivia through banks is a slow, expensive, and uncertain process. The SWIFT system, with its multiple intermediaries, multiplies costs and processing times. Hidden exchange rate fees penalize users, and volume restrictions, combined with banks' lack of liquidity, make the experience frustrating.

In contrast, digital platforms like PrismaPay.net represent a real alternative: fast, transparent, and unlimited. With lower costs, transfers completed in one hour, and real-time tracking, sending money through PrismaPay is positioned as the most efficient option for those who need to send money abroad.

If sending money abroad from Bolivia was once a labyrinth, today the way out is clear: technology has opened the door; all that's left is to walk through it.

Roberto Meruvia